Four key risks to consider for a comfortable retirement

Created On: 21/02/2022

Sometimes saving for retirement is the easy part, it’s how to manage risks when one approaches or enters retirement that can be tricky. There are four key risks in retirement – sequencing of returns, lower-than-expected returns, longevity risk and knowing how much a retiree can spend without falling short. There are other critical issues such as living arrangements and the rising cost of healthcare, but the first four are the key investment risks.

Risk 1: Sequencing risk

Sequencing risk is the risk that the order and timing of an individual’s investment returns are unfavourable – or just plain bad luck.

Consider the scenario below where two retirees begin contributing $250 per month at the age of 25 with the aim to provide $50,000 income p.a. in retirement. During the accumulation phase they both invest in a balanced ‘70-30 growth-defensive’ asset portfolio, and upon retirement move into a conservative ‘30-70’ portfolio. Retiree 1 retires immediately following the Global Financial Crisis (GFC) at the age of 55. Retiree 2 retires two years later at 57, capturing the sharp rebound in markets in the aftermath of the GFC.

While this is an extreme example, and does not consider factors such as tax, inflation and the interaction of retirement savings with the government pension, it does highlight how two years of ‘bad luck’ can be the difference between running out of money at the age of 76 compared to 98 years old.

How can ‘bad luck’ be avoided?

There is not a lot one can do about bad luck; however, investors can plan for it. A possible solution is to invest in a lifecycle strategy which de-risks as individuals age to gradually reduce the size of potential losses in line with the reduction in their human capital (present value of future income from employment). Other options include products with capital guarantees, or goals-based funds which have a dual objective of participating in rising markets but also limiting losses through protection strategies. Being prepared to be flexible around when an individual retires (if possible), such as working part-time for a few more years to smooth the impact of unlucky sequencing, can also make a sizable difference in retirement outcomes.

In a low return environment, retirees may be tempted to lean further into riskier assets (to increase returns), but with little to no remaining human capital that comes with significant risk. A sound transition to retirement risk management strategy in our view is key as most, including Retiree 1 in the example above, cannot afford to lose 30% of their savings in the final years of their working life.

Risk 2: Lower-than-expected returns

The risk of lower returns has become increasingly salient since the GFC, and now COVID-19, as central banks around the world reduced interest rates to record lows in an effort to stimulate economic activity. Only 10 years ago, a retiree could expect to earn 6% on a term deposit1; these days they’re lucky to get 1%. This issue has profound impacts for traditional investment solutions, such as a 50% equities, 50% bonds portfolio, which now has an expected medium-term (5-to-7 years) return of only 4.1%, the lowest it’s ever been2.

Low expected returns are largely a reflection of historically low bond yields, which make up a good portion of retiree’s assets, but also equities which are priced off those risk-free rates. The downward trend in interest rates has seen a steady rise in equity valuations on traditional metrics, such as price-to-earnings, which has brought returns forward but in turn decreased the yield and potential for outsized returns in the future.

What can investors do about it?

A potential solution is to access investment products with diversified sources of return, such as active management and alternative asset classes. The shift to passive investing has driven fees lower and that’s good for investors. However, in a low return environment we believe it

might be time to lean into active management, here’s why:

1. The recent increase in volatility and dispersion has improved the potential for active managers to add value (alpha) - or put simply, there are more opportunities to pick big winners and avoid big losers.

2. The potential return uplift from active management and alternative asset classes, relative to what investors could earn from investing passively in traditional assets, has increased materially over the last decade.

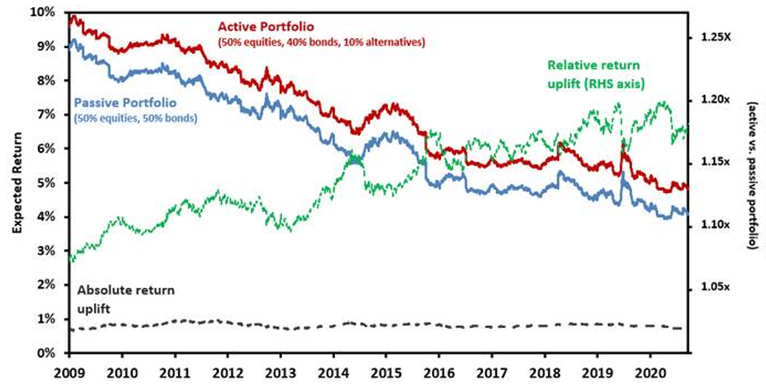

To illustrate point 2, the following chart plots the expected return of two portfolios – a passive portfolio made up of 50% equities and 50% bonds which is compared against an actively managed portfolio made up of 50% equities, 40% bonds and 10% alternative assets. The ~1% potential return uplift, in absolute terms (black dash), from active management is constant over time but the relative return uplift (green dash) has improved more than two-fold from a 7% to 18% increase. In other words, a 1% increase in expected return is more valuable to retirees if their current expected medium-term return is 4.1% when compared to an expected return of 9% back in 20093.

*Alternative assets target an absolute return of cash + 3.5%. The active portfolio aims to deliver 0.5% in excess returns after fees. This case study is illustrative only. Source: AMP Capital It would be remiss not to mention that excess returns from active

management is far from guaranteed. In our view, it has destroyed value in many cases through lacklustre performance, excessive fees, or both. The key point is that the environment for and relative reward of applying active management has improved and for retirees seeking greater returns it presents a viable option.

Risk 3: Longevity risk

Longevity risk refers to the risk of a retiree living beyond their savings. The crux of this issue relates to designing an investment solution with an undefined investment horizon – no mean feat. In our view, it is problematic to save enough income for retirement based on an individual’s average life expectancy as there is a good possibility that one could live beyond this estimate. Joint probabilities exacerbate the issue, for example a male and female couple at the age of 67 has a life expectancy of 85 and 87 years, respectively. However, their joint life expectancy is 92 years - and there’s a 10% chance one will live beyond 99 years of age4. Saving based on averages can be a precarious game.

If investors can’t use life expectancy to plan for retirement, what can be used?

Longevity risk can be fully insured against through an annuity, but in a low interest rate environment they can be expensive and may offer inadequate income. Reverse mortgages, if structured the right way, could also play a role. A lifetime pension solution, which pools the assets of retirees with the aim of sharing and mitigating longevity risk may also be an option for retirees looking for greater certainty that their income won't run out. The industry is relatively immature in this space; we along with others in the market are looking to innovate in this area to solve for the issue of longevity in a cost-effective and transparent way.

Risk 4: Spending in retirement

Closely related to longevity risk is the dilemma of how much to spend in retirement. More than half of retirees older than 65 currently draw down at the minimum statutory rate from their account-based pensions5, and as a result many leave substantial balances when they pass away. The Australian Government’s Retirement Income Review (2020)6 found that retirees: are reluctant to draw down at higher rates due to complexity; receive poor guidance around how to optimise retirement income; have concerns about their future health and aged care costs; and have concerns about outliving their savings.

The review presents a harrowing look into the psyche of many retirees who seek to self-insure against the risk of running out of money by being overly stringent on their spending, resulting in retirement living standards well below that of their working life. The reality is that many retirees could have lived a much more comfortable retirement with greater confidence to spend if they’d had a plan to deal with longevity risk. For many, a good strategy around how much to consume in retirement to best make use of their savings is arguably more important than their investment strategy.

Too many risks to balance?

The challenge for many pre-retirees and retirees is coming up with a solution that adequately balances all four risks – this is where good advice can play a role. Seeking greater returns may increase an individual’s sequencing risk, whilst being too conservative with one’s longevity strategy can result in living significantly below their means. The key for retirees is to ensure they are aware of all four risks; understand how their investment and spending strategy exposes them to each; and ensure this aligns with their risk preferences, values and long-term plans for retirement.